Well, also that being bigger means you’re less vulnerable to smoke or toxic has inhalation, which is what kills most people.

- 1 Post

- 19 Comments

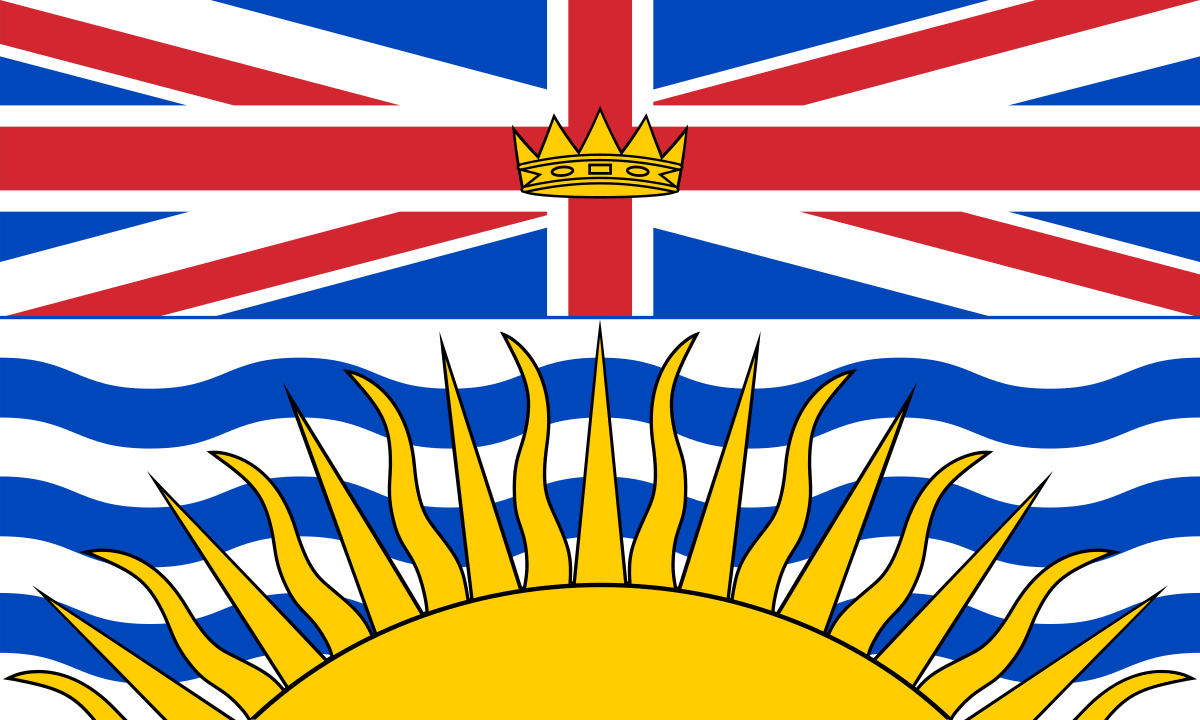

Pop rep wouldn’t have changed much for NDP/Con numbers.

STV, though, would have been an absolute gamechanger

Unless you’re going to tell me that Itch has a dynamic library filtering setting, family-sharing, the ability to have local machines on the network speed up my downloads, and the ability to dynamically remap controller profiles per-game, then yeah, steam is more user-friendly.

I don’t understand the point of making a coin that has ~$3500 worth of gold in it, and then giving it an official face value of $50.

Even big singleplayer games can be fun. I liked being involved in the early days of BG3’s release, for example. But then again, no mans sky and cyberpunk sucked

There was a time where the fact that launch meant a high player count, big community energy, and lack of hyper-optimized strategies minmaxxing the fun out of a game was sufficient reason to get it at launch.

But given how often modern launches are bungled, even that is not always true

3·2 months ago

3·2 months agoYou are telling me that statistically speaking, a store is likely to be crashing into within 3 years of its most recent crash

13·2 months ago

13·2 months agoIf the error is hidden well, yes. Close-reading a text and cross referencing everything it says takes MUCH longer than writing a piece you know is accurate to begin with

2·2 months ago

2·2 months agoThe next update will fix everything, just need this one hotfix and everything will be solved, just wait.

Just one more update, okay? Just one more. One update. Just one.

I take it you’ve never been on a job site, because there is a TON of infrastructure and protocol that cranes and crane operators have to follow to make sure everything is as safe as possible.

You need to have extensive training to be allowed to do overhead materials handling, the ground conditions need to be thoroughly checked, the job site needs to be planned and laid out, in general there are a ton of constraints and checks to make sure that there is virtually zero risk that a random person could accidentally walk into a danger zone and get hurt.

That’s pretty much the exact opposite as with cars. Pretty much every parking lot I have ever been to is front-loading, which REQUIRES that pedestrians have to cross the main driving path to get to their destination and there is very little training and certification required of drivers compared to crane operators.

It also takes like 10 minutes of inhaling chloroform for it to knock you out like that

Tigger’s manic denial that he is lonely, and insistence that he is “wonderful” because “I’m the only one” has always hit me as a horribly depressed person feigning mania to hide/run from their awful situation

Eeyore at least is in touch with his feelings

And in fact, increasing the tax on profits makes it much, much more valuable to reinvest in the business.

Like, lets say your business is expecting a net profit of $200K after a year. You can either choose to reinvest that into the business to buy new equipment and hire new staff, or you can record that as profit, pay the taxes, and then put the after tax dollars money directly into your and your investors pockets.

With our current corporate tax rate of 15%, it’s really tempting to just pay the 30K in taxes and personally keep $170k as take-home, which gets taxed at a MUCH lower rate than regular income, rather than keep it in the business. $30K as a fee to keep $170K in personal income is pretty cheap.

However, if taking money our of the business was much more expensive, say 45% or something comparable to the marginal personal income tax rate for a working professional, then maybe as a business owner you might think that paying $90K to keep $110K is not as good a deal, and so you will think about whether there are other opportunities WITHIN the business you could invest in, putting those profits towards new equipment or training, rather than losing 45% of it to taxes just to add a small amount to your own pocket.

They want them even more as middle managers.

The CEO’s goal is to be able to say “we had the best intentions, I have no idea how it went so badly”, and that requires a bunch of layers of middlemen who are willing to do anything to meet targets

6·3 months ago

6·3 months agoMercedes was the name of Emil Jellinek’s daughter, Emil has the idea to develop sports cars, he designed and commissioned cars from an engineering company and named the model-line after her.

11·3 months ago

11·3 months agoRemoved by mod

213·3 months ago

213·3 months ago“Exempli Gratia” literally translates to “Example Given”, so I’d say yes, it does stand for that?

2·9 months ago

2·9 months agoThis is a classic case of the Patriarchy / Toxic Masculinity hurting men too.

For the government officials to fund a Men’s shelter would mean admitting that men can have moments of weakness, which the men in power do not like.

1·1 year ago

1·1 year agoThis strongly reminds me of the Rimworld community.

Like, Rimworld ALLOWS you to do slavery, organ harvesting, cannibalism, and all sorts of wild shit within its systems, and the young-male fans of the game talk that up a lot.

…but the reality is that most people set up a nice little farm and spend most of their time making art and decorating their base and playing matchmaker.

Name one.